MINNEAPOLIS — The agriculture economy in the northern Plains was “rather negative” in the first quarter of 2024, a regional economist said, and bankers expect a negative second quarter, too.

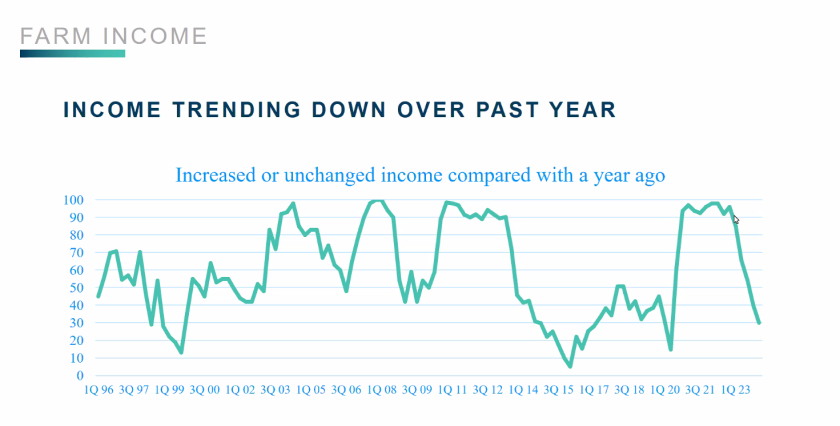

Joe Mahon, Minneapolis Federal Reserve regional outreach director, in a webinar Monday discussing , said the income picture for farmers is “not as bad as it could be, but certainly not great, and a consistent downward trend.”

ADVERTISEMENT

The Fed conducts a quarterly survey of ag lenders in Minnesota, Montana, North Dakota, South Dakota and portions of Wisconsin and Michigan, which makes up the Fed’s Ninth District. The most recent survey of 60 bankers was conducted in April, with lenders looking back on the first quarter and giving an outlook into the second quarter. Mahon explained that agriculture plays an outsized role in the economy of the Ninth District as compared to the rest of the U.S. The economy of North Dakota, in particular, he said, is tied to agriculture in a way that other places are not.

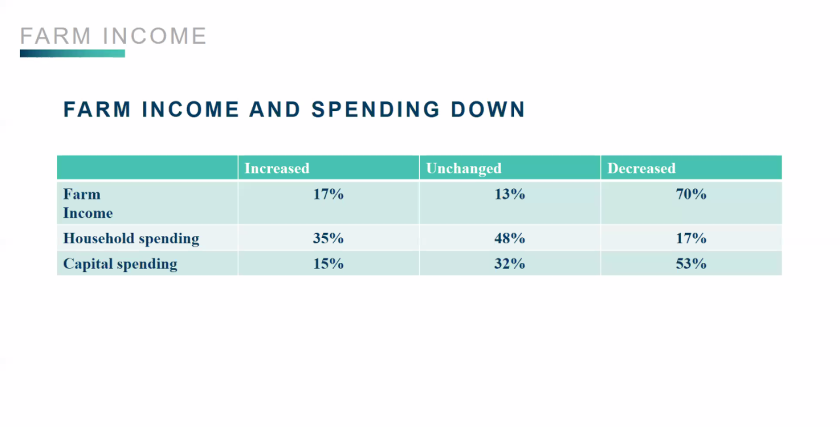

The survey showed that farm income and farm spending, overall, decreased in the first quarter of 2024 for farmers in the Ninth District, while household spending increased. Loan demand and renewals were up while repayment was down. Land prices and rental rates increased slightly, but not as much as in previous quarters.

Given depressed grain prices, that negative outlook was mostly expected, Mahon said.

“This was not entirely surprising,” he said.

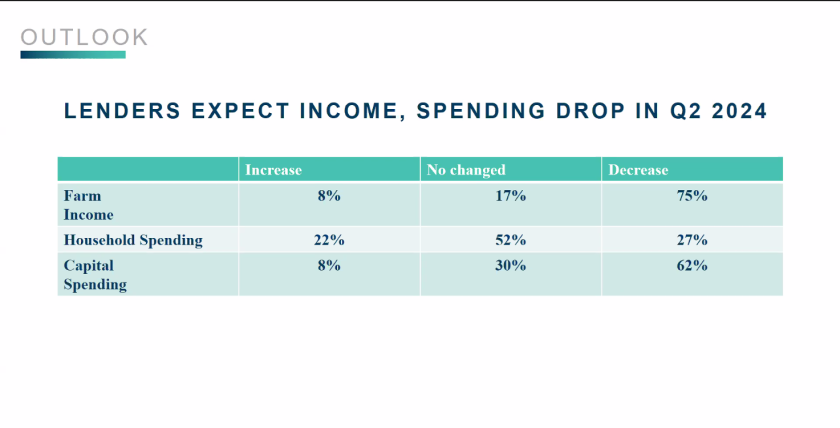

Lenders expect income and farm spending to drop again in the second quarter, and most also expect household spending to decrease.

“This is kind of an indicator that more lenders are expecting belts to start tightening among farms,” Mahon said.

While interest rates began to tick downward — one highlight of the report — they’re still high compared to the past 20 years, Mahon said.

ADVERTISEMENT

But Mahon did note one other bright spot in the region: cattle production. He quoted one North Dakota lender’s response on the survey as “Cattle men are happy. Wheat farmers are not.”

He explained that cattle prices have continued to hold up, especially compared to other commodities, and the lower grain prices — corn prices in particular — are a positive for cattle producers who use corn as an input to feeding cattle.

The positive first-quarter results and positive second-quarter outlook for cattle were most visible by looking at survey responses from Montana and the western Dakotas, where cattle production is more prevalent, he said.

“The cattle picture is relatively good,” Mahon said.

Meanwhile, the hog industry has not fared as well, though it also has benefited from lower grain prices for feed. But market prices have remained relatively weak, and Mahon said that can be seen in results from southern Minnesota — one of the “centers of hog production in the world” — where economic indicators are what he would “loosely characterize as being a little weaker.”