BISMARCK — When states are ranked, it's not often North Dakota appears next to places like Hawaii, New York or California.

But when it comes to states where young adults are buying homes, have reported North Dakota ranks in the bottom 10 — next to states known for being densely populated and having a high cost of living.

ADVERTISEMENT

The data that ranks states by homeownership rates for adult residents under 35 was compiled by a management company called Evernest that oversees 22,000 properties across the country. The company used data related to income levels, average listing prices and census numbers to come up with

While North Dakota scored poorly in relation to other states, Minnesota topped the list as the only state in the country where homeownership rates for people under age 35 is over 50%.

In North Dakota, 36% of people under 35 own homes, which makes the state dead last among the Midwest states and 40th nationwide.

Explaining housing trends with a single data point is nearly impossible, experts say, but they agree the national reports are probably right: it's becoming increasingly difficult for young North Dakotans to buy homes.

'It's something nobody really has a grip on right now'

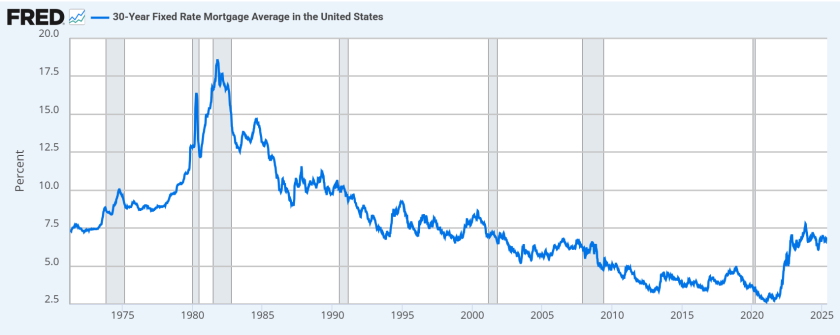

David Flynn, an economist who works at the University of North Dakota, said climbing interest rates and home prices seem to be among the many reasons why young people are intimidated out of purchasing a home.

The average interest rate is sitting at 7%, more than double what it was a few years ago.

Americans have experienced high interest rates in the past, but there is a discernibly wider gap between the cost of housing and the average income, especially in North Dakota, a state housing expert said.

ADVERTISEMENT

“You can afford that much more home if your interest rate's that low," said Brian Dettlaff, the homeownership director at the North Dakota Housing Finance Agency. "Now, interest rates are high, and so are home prices.

“We have this historic climb of housing prices, but salaries have stayed fairly stagnant," he said of North Dakota. “When is it going to plateau?”

According to the number of North Dakota households earning more than $125,000 per year has risen, but the number of middle-class households has stayed the same, and so has the poverty rate. Half of North Dakota households earn less than $75,000 per year, and a third bring in below $50,000 annually.

As such, the report found homeownership rates have fallen dramatically in the last decade.

Low- and middle-income households experienced the biggest decline, with the number of homeowners dropping by nearly 20% between 2012 and 2022. In the same period, monthly housing costs — like insurance and utilities — rose by nearly 40% on average.

The report didn't specifically tie age to homeownership rates.

Meanwhile, housing prices have surged similarly between North Dakota and Minnesota, according to data from the United States Federal Reserve.

ADVERTISEMENT

Such patterns seem to be making young people “a little more cautious” about putting down roots, Flynn said, emphasizing the impact of living through events like the 2008 recession and the COVID-19 pandemic. But that does not explain why more young people would buy homes in Minnesota compared to neighboring North Dakota.

"It's something nobody really has a grip on right now," he said. "How young people change spending patterns from previous generations, there's always a little bit of a smear about it, like, 'oh, young people are doing things either right or wrong.' But in fact, if it's done with the understanding that you're going to have less money later, and you want to spend it now because you have it now (and) you want to enjoy it — that's hard to argue against. “

The 2024 report estimated, based on change in population by age and the state’s housing inventory, North Dakota would need to add more than 20,300 housing units by 2027 to meet the need — a 6% increase in demand from 2022.

"There’s just not a ton of homes out there that some of these first-time home buyers can buy,” Dettlaff said.

“It’s a really weird paradigm we’re in right now because the state could give us $100 million to go build housing. We could do all these programs throughout the state, but who’s going to build it?” he continued. "There’s not even enough contractors" to build affordable homes in general, let alone starter homes.

What does Minnesota do better?

More affordable housing leads to more people buying homes, both Dettlaff and Flynn emphasized.

There's a stark difference in the housing dollars doled out between the two states.

ADVERTISEMENT

Though Minnesota's housing budget hasn't been finalized, it's on affordable housing programs within its two-year budget.

On the other hand, the North Dakota Legislature tends to take a more privatized approach, allocating $25 million for similar initiatives for the next biennium. The dollar amount came in at

The money is in limbo, however, after

State funding aside, North Dakota's culture — its low population, lack of job mobility and geographical isolation — continues to work against its ability to maintain its younger population, according to Flynn.

Although the encompassing a notable increase in young residents, he said, it's hard to say whether they are staying.

It's nearly impossible to quantify, but it's likely Minnesota, especially its metro areas, is retaining more of its young population because its job market is more diversified, it's more populated and has more access to leisure and recreation activities, Flynn added.

Katie Johansen, a licensed real estate agent in North Dakota and Minnesota with Berkshire Hathaway HomeService, said she works with a lot of young buyers and isn’t surprised Minnesota leads the pack for young people becoming homeowners.

ADVERTISEMENT

“Especially with the Twin Cities, you have a ton of young professionals buying homes. Plus, there’s a lot of people in that area,” said Johansen, who has been in the real estate market in the two states for 12 years.

"Fargo in particular doesn't always follow the trends for North Dakota," she said. "As a metro, we tend to be a lot more urban than the rest of the state."

Johansen was showing Andrea Smith, 26, a home in the Fargo area on Thursday, May 23. Smith, who grew up in Horace and moved to Bismarck to attend the University of Mary, is looking to buy her first home.

Now that she’s graduated and moved back to the area, she said, she felt it was time to buy a home.

Experts agree that finding ways to encourage more people like Smith to buy a home in North Dakota is not an easy task.

“There’s going to need to be a lot of different approaches,” Dettlaff said, calling on the younger generation to voice their concerns to state leaders.

Flynn also highlighted how complex it will be at the state level to make finding affordable housing easier for young people.

ADVERTISEMENT

"It's not something that a reasonable person should sit there and say 'the solution is this,'" he said.